- Baked In

- Posts

- 💸Welcome To The Thunderdome

💸Welcome To The Thunderdome

GM Everyone,

“To the victor go the spoils.”

💸 The Tape

If 2025 had a theme for the cannabis industry, it was this: survival mode is over; execution matters again. After several bruising years defined by capital scarcity, regulatory gridlock, and a near-universal allergy to dilution, the industry quietly began to find its footing. Not with fireworks—but with fundamentals.

2025: The Year Cannabis Grew Up (Mostly)

The biggest story of 2025 wasn’t a blockbuster legalization vote or a meme-stock rally. It was discipline.

Across both Canada and the U.S., operators finally accepted reality: scale without profitability is not a strategy, it’s a liability. The winners were companies that focused on core markets, operational efficiency, and balance-sheet repair. Asset sales replaced empire-building. Convertible debt got cleaned up. Margins—long forgotten—returned to earnings calls.

In Canada, the market continued its slow but steady maturation. Monthly national sales consistently hovered above CA$400 million, pushing full-year totals toward record territory. The country’s retail footprint stabilized, pricing pressure eased, and top operators leaned into loyalty programs, private-label products, and SKU rationalization rather than endless store openings.

Meanwhile, Canadian LPs quietly rediscovered international medical cannabis. Europe—especially Germany—reemerged as a growth engine, not a slide deck bullet point. Export volumes climbed, GMP assets mattered again, and medical margins reminded investors what cannabis looks like when excise taxes don’t eat the whole pie.

In the U.S., the story was more political—but no less consequential.

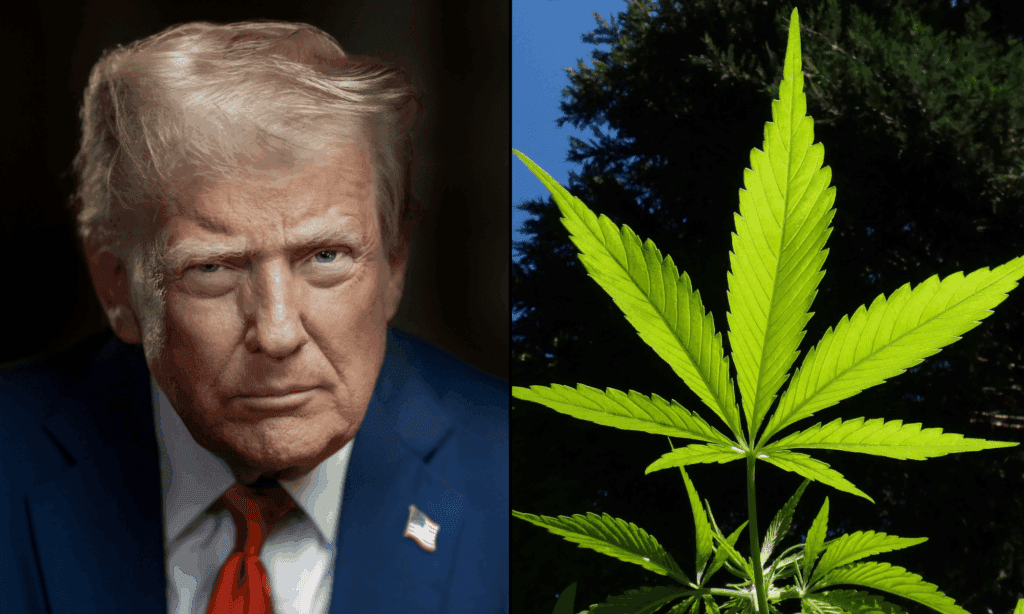

After years of “someday soon,” marijuana rescheduling finally moved from rumor to reality. President Trump’s executive order directing the DOJ to finalize a move from Schedule I to Schedule III didn’t legalize cannabis—but it did something arguably more important: it made reform bipartisan and unavoidable.

Markets reacted immediately. Tax relief via the elimination of 280E went from theory to timeline. Institutional investors—long constrained by compliance rules—began circling again. Even skeptics had to admit: cannabis no longer lived in the same legal bucket as heroin.

And yes, volatility returned. MSOS reminded everyone it’s still MSOS. But beneath the daily swings, capital started paying attention again.

M&A Came Back (But Smarter)

Another quiet shift in 2025: M&A returned with adult supervision.

Instead of grand “mergers of equals,” the year favored asset-level deals, market exits, and bolt-on acquisitions. Operators sold non-core states, refocused on profitable footprints, and stopped pretending every license was sacred.

Debt holders got creative. Equity got cheaper. And management teams—finally aligned with shareholders—made pragmatic choices. It wasn’t glamorous, but it worked.

What to Watch in 2026: The Year of Consequences

If 2025 was about positioning, 2026 will be about results.

First, Schedule III actually hitting matters. Once finalized, operators will feel the impact in real financial statements—not just pro forma slides. Expect sharper earnings comparisons, cleaner cash flow profiles, and renewed conversations around uplisting eligibility and institutional coverage.

Second, state-level legalization is back on the table. Pennsylvania sits at the center of the map, but it won’t be alone. With federal risk reduced and political cover expanded, lawmakers who were previously “concerned” may suddenly find clarity. Even red states are talking medical frameworks again.

Third, banking doesn’t magically fix itself—but pressure will intensify. SAFER Banking may not pass overnight, but rescheduling makes the status quo harder to defend. Financial institutions dislike uncertainty, and 2026 offers less of it than we’ve seen in years.

Finally, expect capital markets to reopen selectively. Not everything will be fundable. Not everyone deserves it. But companies with real margins, real governance, and real strategy will find doors opening that were firmly shut just a year ago.

Bottom Line

The cannabis industry didn’t moon in 2025—but it stabilized, recalibrated, and matured. That’s far more important.

2026 won’t reward hope or headlines. It will reward operators who can execute in a post-excuses environment. For the first time in a long time, cannabis isn’t asking for patience.

It’s asking to be judged like a real industry again.

🗞️ The News

📺 YouTube

What Changes After Rescheduling? | Trade to Black

What we will cover:

✅ Was last week’s market pullback just nerves—or was it the market trying to reset after years of uncertainty?

On this episode of TDR Trade to Black, we kick off 2026 by stepping back and looking at what actually matters next for the cannabis industry. Shadd Dales is joined by Peter Sack of Chicago Atlantic (NASDAQ: REFI | NASDAQ: LIEN), one of the most active lenders in cannabis, to talk through how sentiment is shifting now that federal rescheduling is officially in motion.

We discuss President Trump’s cannabis rescheduling executive order, why it matters from a capital and lending perspective, and why this moment feels different from the false starts investors have seen in the past. Peter shares how operators and lenders are reacting behind the scenes, where conversations are picking up, and why more people are starting to lean back into the space after sitting on the sidelines.